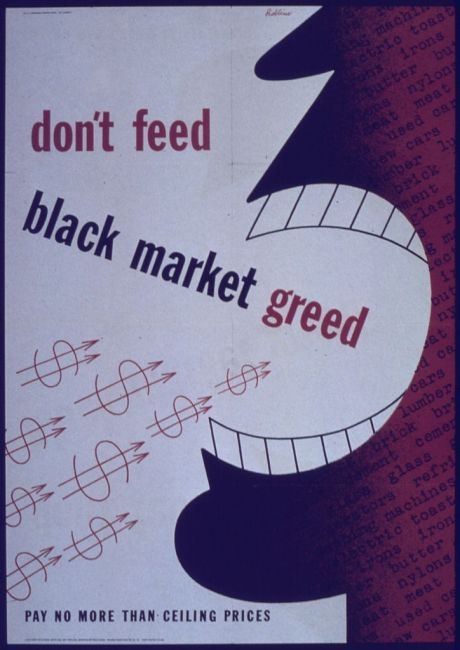

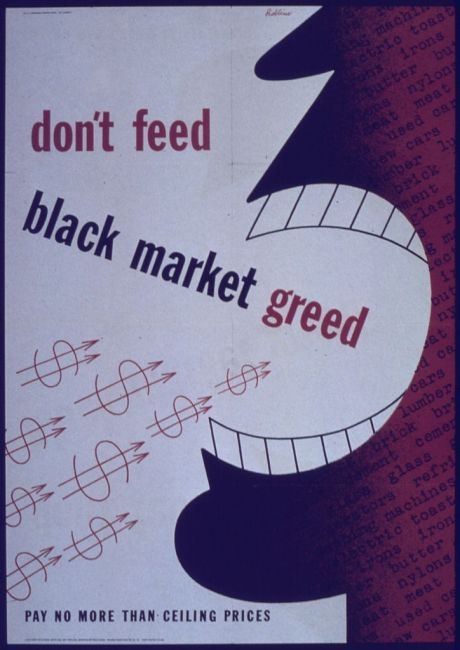

Taking stock of Europe's black market

'Don't_Feed_Black_Market_Greed' - NARA

By Unknown or not provided (U.S. National Archives and Records Administration) [Public domain], via Wikimedia Commons

Researchers have developed an economic model to analyse the effects of the informal economy in Europe in order to examine how it relates to economic growth and policy.

The informal economy refers to activities and income generation that

take place outside the formal economy, and upon which no tax or social

contributions are paid. The size and presence of this informal (also

called underground or shadow) economy is giving rise to major policy

concerns among EU governments.

Funded by the EU, the FISINF (Fiscal policy and informal economy over the business cycle) project was set up to help address this challenge. It developed an economic model using state-of-the-art techniques in dynamic macroeconomics.

The model was used to analyse various effects of Europe's informal sector. To achieve its aims, the project studied how the informal economy affects fiscal policy and, therefore, economic growth and total productivity over the business cycle.

More specifically, the research work was conducted in three stages. The project first collected and arranged data on the key variables involved, such as gross domestic product and institutional control variables for European countries. It then conducted an empirical analysis of the data collected. A theoretical model was subsequently designed during the project's third stage in an effort to understand the economic mechanism behind FISINF's observations.

After the first two stages were completed, the economic model was built and calibrated. It was then used to generate various policy scenarios that were examined for their effect on reducing the informal sector's size and scope.

The results of this exercise were published in several journals and papers. This material could be crucial in helping to reduce the size of this ever-growing sector and its related tax and social security avoidance issues across the EU.

published: 2015-11-16